coweta county property tax records

Coweta County Justice Center 72 Greenville Street Newnan GA30263 PHONE. Gwinnett County collects on average 1 of a propertys assessed fair market value as property tax.

Coweta County Government Facebook

Is graduate of the University of Maryland School of Law a Maryland State Registered Tax Preparer State Certified Notary Public Certified VITA Tax Preparer IRS Annual Filing.

. Early Voting for the November 8 General Election is underway through November 4. Gwinnett County has one of the highest median property taxes in the United States and is ranked 479th of the 3143 counties in order of median property taxes. Public Property Records provide information on homes land or commercial properties including titles mortgages property.

And 430 pm Monday-Friday payment windows close at 430 pm. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Assessment and Tax into a single user friendly web application that is designed with your needs in mind.

The median property tax in Gwinnett County Georgia is 1950 per year for a home worth the median value of 194200. At either Early Voting locations 22 E. The median property tax in Fort Bend County Texas is 4260 per year for a home worth the median value of 171500.

- 5 pm Saturday October 22 from 9 am. Coweta County Transit Meetings are held in the Commission Chambers located at 37 Perry Street second floor Newnan GA 30263. Every effort has been made to include information based on the laws passed by the Georgia Assembly during the previous session.

Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. The information provided is for tax purposes only and not legally binding. NETR Online Coweta Coweta Public Records Search Coweta Records Coweta Property Tax Georgia Property Search Georgia Assessor.

39 Hospital Road Newnan GA 30263 PHONE. The Complex consists of two buildings. Fort Bend County collects on average 248 of a propertys assessed fair market value as property tax.

The median property tax in Cuyahoga County Ohio is 2649 per year for a home worth the median value of 137200. Clayton County Property Records are real estate documents that contain information related to real property in Clayton County Georgia. NETR Online Fulton Fulton Public Records Search Fulton Records Fulton Property Tax Georgia Property Search Georgia Assessor.

The Coweta County version of Freeport differs slightly from the state version. Early Voting for the November 8 General Election is underway through November 4. The information is as accurate and up to date information as possible.

The main Justice Center at 72 Greenville Street houses multiple court functions. Filing a property tax return homestead exemptions and appealing a property tax assessment. Broad Street Newnan and 65 Literary Lane Newnan.

And Saturday October 29 from 9 am. Kaufman County has one of the highest median property taxes in the United States and is ranked 251st of the 3143 counties in order of median property taxes. Cuyahoga County collects on average 193 of a propertys assessed fair market value as property tax.

770-683-PARK7275 The Parks Recreation Department proudly offers dozens of different opportunities at various locations across the county for citizens of all ages and interests. Fresno County has one of the highest median property taxes in the United States and is ranked 658th of the 3143 counties in order of median property taxes. Monday - Friday 800 AM - 500 PM All fine payments are processed between the hours of 8 am.

The Probate Court of Coweta County is an Article 6 Probate Court Title 15 Chapter 9 Article 6 Official Code of Georgia Annotated which means that it has enhanced or expanded jurisdiction. Joy Thompson-Brown Business License Associate. Broad Street Newnan and 65 Literary Lane Newnan.

Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. 19 Million Property Records. 1100 AM - 1200 PM.

22 East Broad Street Suite 128 Newnan GA 30263 PHONE. - 5 pm Saturday October 22 from 9 am. Kaufman County collects on average 2 of a propertys assessed fair market value as property tax.

From the Marvel Universe to DC Multiverse and Beyond we cover the greatest heroes in Print TV and Film. This section provides information on property taxation in the various counties in Georgia. At either Early Voting locations 22 E.

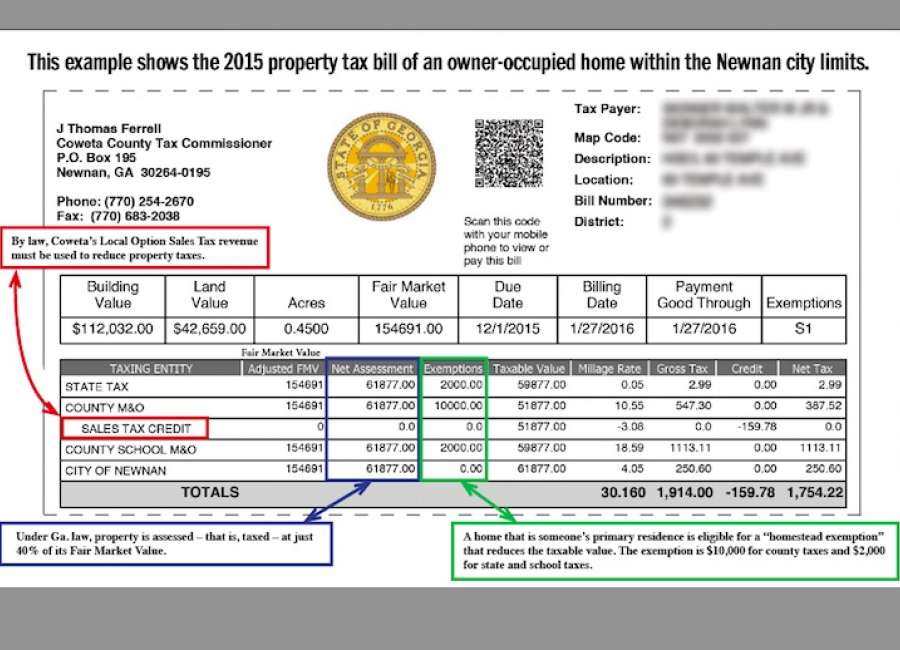

Contact the Personal Property Division of the Tax Assessors office at 770-254-2680 for specific information and filing requirements. The goal of the Coweta County Tax Assessors office is to annually appraise at fair market value all tangible real and personal property located in Coweta County by utilizing uniform methods and. The majority of court services are located in the Justice Center Complex on Greenville Street in Newnan.

Under Article 6 which applies in counties having a population of 96000 or more the probate judge must be a licensed attorney with experience and. Lea Uradu JD. 22 East Broad Street Suite 222 Newnan GA 30263 PHONE.

Cuyahoga County has one of the highest median property taxes in the United States and is ranked 241st of the 3143 counties in order of median property taxes. We would like to show you a description here but the site wont allow us. The median property tax in Kaufman County Texas is 2597 per year for a home worth the median value of 130000.

Coweta FireRescue Headquarters 483 Turkey Creek Road Newnan GA 30263 EMERGENCY. Fort Bend County has one of the highest median property taxes in the United States and is ranked 57th of the 3143 counties in order of median property taxes. And Saturday October 29 from 9 am.

Early Vote Monday - Friday from 9 am. The median property tax in Fresno County California is 1666 per year for a home worth the median value of 257000. Box 884 Newnan GA 30264 Hours of operation.

Fresno County collects on average 065 of a propertys assessed fair market value as property tax. Early Vote Monday - Friday from 9 am. Courts serving Coweta County are housed at several locations around Newnan.

Coweta County Public Records.

Board Of Commissioners Coweta County Ga Website

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

Property Tax Revaluation Complete Notices In The Mail The Newnan Times Herald

Property Tax Bills Sent Due Dec 1 The Newnan Times Herald

A Timeline Of Black History In Coweta County The Newnan Times Herald

Cowetaliving2016 Lowres By The Times Herald Issuu

Coweta County Statutory Power Of Attorney Form Georgia Deeds Com

950 000 Square Foot Warehouse Development Proposed In Coweta County Atlanta Business Chronicle

Geographic Information Systems Gis Coweta County Ga Website

Press Release Proposed Property Tax Increase The City Menus

C D Landfill Coweta County Ga Website

Coweta County Georgia Genealogy Familysearch

Administration Coweta County Ga Website

Coweta County Government 2020 Notices Of Assessment 2020 Notices Of Assessment Were Mailed On Friday June 26 2020 The 2020 Noa Is The Culmination Of A Three Year Revaluation Project For All

The Coweta County Museum Newnan Georgia 2004

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald